Top 10 Research Publications in 2016

Which country has the fastest growing wealth? Why is everyone targeting at the wealthiest? What are billionaires doing? How about the affluent clients? How about the mass market? What wealth management services do they need?

” I often remind our analysts that 100% of the information you have about a company represents the past, and 100% of a stock’s valuation depends on the future ”

~ Bill Miller

We review the top 10 Research Publications in 2016 that provides high quality, in-depth and extensive coverage and research for the Wealth Management Industry in Asia.

Global Wealth

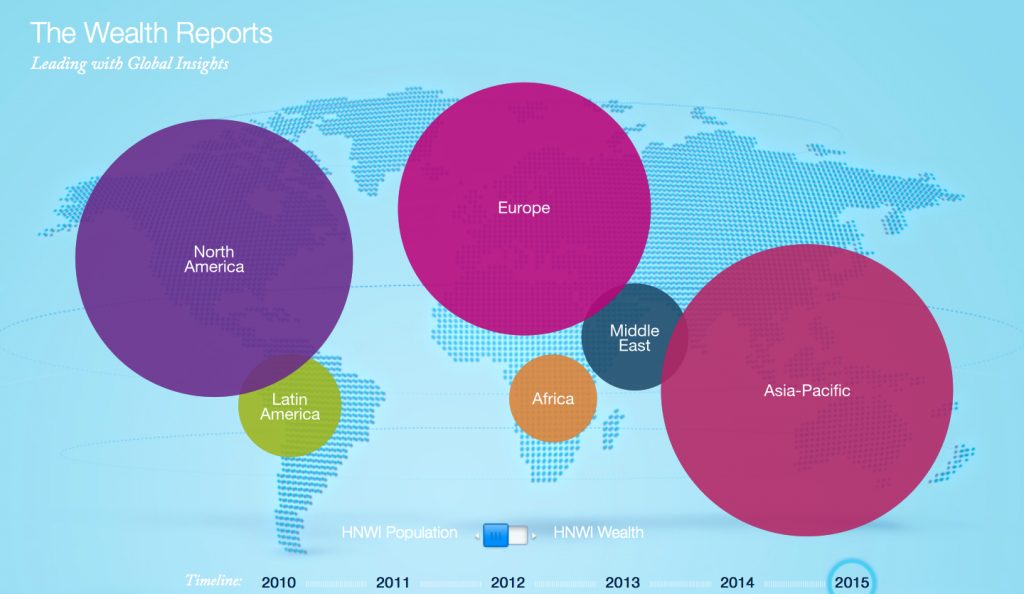

#1 Capgemini World Wealth Report 2016

How did wealth grow in 2015? Which are the fastest growing countries? Which country suffered the most in wealth growth rate?

The Capgemini World Wealth Report is the leading and most comprehensive global wealth report. It is published annually.

About the Report

The World Wealth Report 2016 by Capgemini is the industry’s leading benchmark for tracking high net worth individuals (HNWIs), their wealth, and the global and economic conditions that drive change in the Wealth Management industry.

- Read More: Capgemini World Wealth Report 2016

- Published By: Capgemini

#2 Wealth-X 2015 to 2016 World Ultra Wealth Report

If you are providing wealth advisory to Ultra High-networth, this is a report not to be missed.

Wait a minute, what is Ultra High-networth? Who qualifies? Is it individuals with more than $10 Million or $15 Million? Ultra High-networth individuals are usually (2016) as having more than $30 Million investible assets.

About the Report

Wealth-X presents the World Ultra Wealth Report 2015-2016 revealing that there are 212,615 ultra high net worth (UHNW) individuals globally, holding a combined wealth of US$30 trillion in net assets.

- Read More: Wealth-X 2015 to 2016 World Ultra Wealth Report

- Published by: Wealth-X

#3 Wealth-X Report 2015 to 2016 – Billionaire Census

Do you know there are more than 2,000 billionaires in the world? Combined, they held almost $7.7 trillion of global wealth.

About the Report

The third edition of this preeminent report indicates that there are 2,473 total billionaires in the world, representing a combined wealth of US$7.7 trillion. These figures illustrate a 6.4% and 5.4% increase since 2014, respectively.

- Read More: Wealth-X Report 2015 to 2016 – Billionaire Census

- Published by: Wealth-X

#4 Wealth-X Report 2016 – Preparing for Tomorrow: A Report on Family Wealth Transfer

How old are the world’s wealthiest people today? How old is Warren Buffett and Li Ka-shing? Who will they pass on their wealth to? Who will manage their wealth?

About the Report

“Preparing for Tomorrow: A Report on Family Wealth Transfer” takes an in-depth look at the most pertinent issues and challenges UHNW individuals face when transferring wealth to the next generation. The report, which was produced by Wealth-X and sponsored by NFP, includes insight and best practices for family wealth transfers and the associated assets of the ultra wealthy.

- Read More: Wealth-X Report 2016 – Preparing for Tomorrow: A Report on Family Wealth Transfer

- Published by: Wealth-X & NFP

The Rich List

#5 The Forbes List

The most awaited publication every year. Who are the richest people in Hong Kong? In Malaysia? In Singapore? In Indonesia? In China or United States?

Every year, Forbes produced the exclusive richest list in almost every country.

- 2016 Hong Kong Top 50 Richest

- 2016 Indonesia Top 50 Richest

- 2016 Malaysia Top 50 Richest

- 2016 Singapore Top 50 Richest

- 2016 Australia Top 50 Richest

- 2016 United States of America Top 50 Richest

Private Banking

#6 Rethinking Private Banking in Asia-Pacific: An EY Discussion Paper for Bank Executives

Now that you know much about Global Wealth and the Rich, it is now time to craft an optimal strategy. What do you do? Should you invest ahead? How should you create a sustainable Private Banking growth strategy in Asia-Pacific?

About the Report

Poised at the center of the world’s fastest growing and soon-to be largest wealth markets, the potential upside for Asia-Pacific’s private banks and wealth managers is clear. Yet, realizing the exciting potential of the region’s wealth hubs is challenging.

- Read More: Rethinking Private Banking in Asia-Pacific: An EY Discussion Paper for Bank Executives

- Published by: EY

#7 2016 Global Private Banking Report – Scorpio Partnership

After all the research, analysis and summary, if you are in finance – all you might want to find out is: Which is the largest Private Bank in the world?

Find out more in the 2016 Global Private Banking Report.

- Read More: 2016 Global Private Banking Report – Scorpio Partnership

- Published by: Scorpio Partnership

# 8 Asian Private Banker AUM

Can’t get enough of measuring against your Private Banking peers? Get more information on Asian Private Banking Assets under Management (AUM) and Relationship Managers (RM) headcount.

- Read More: 2015 AUM & RM Headcount League Tables – Asian Private Banker

- Published by: Asian Private Banker

Insurance

#9 Capgemini & Efma: World Insurance Report 2016

- Read More: Capgemini & Efma: World Insurance Report 2016

- Published by: Capgemini & Efma

#10 Caproasia Institute

Ever wonder where research produced by Caproasia Online originate from?

Selected Research

- List of Global Top 50 Fund Management Firms 2016

- 2015 Global Personal & Corporate Tax Rate at a Glance

- 2015 Stock Exchange Market Capitalization

- List of Sovereign Wealth Funds 2016

- List of Popular Offshore Financial Center & Jurisdictions in 2015

- List of Credit Rating Agencies

- List of Financial News Agency

- 2016 Top Digital Financial Publications in Asia

Join us in the 2016 Rewind:

- The 2016 Ultimate Rewind

- Top 5 Most Shocking News in 2016

- The Rewind: Private Banks in 2016

- Top 50 People Moves in 2016

- Top 5 Professionals Who Left Private Banking in 2016

- Top 10 Research Publications in 2016

- The Rewind: Fund Management in 2016

- Top 10 Most Popular Articles in 2016

- Top 20 Most Popular Articles in 2016

- Top 10 Most Popular Videos in 2016

- Top 50 Most Memorable Photos in 2016

- Photoshot of the Year 2016

- Top 30 Headlines in 2016

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit