10 Steps to Start Advising Clients Every Year

How do you get started every year? Do you have a strategy for your clients? Can you build up your clients and AUM effectively?

No. 1 The Review or The Forecast

Perhaps the worst message for any Advisor or Investment Specialist to hear from client is to liquidate all portfolio to invest in properties.

Fortunately, clients often put the thought across but rarely do it. But if you have a sizeable number of clients, the odds on happening is always there.

The first meeting of the year usually starts with a quick review and the expected forecast for the year.

- 3 Secrets What Top Wealth Managers Do Everyday

- 8 Essential Skills to be a Top Wealth Manager

- 10 Questions Every Client Will Ask Every Year-End

- How Do You Conduct a Year-End Review for Your Clients?

No. 2 Interest Rates Trends

Unless there is a unique situation such as a high profile bankruptcy, a good meaningful exchange with client usually begins with a discussion on the interest rates trends.

- What is the current interest rate?

- Which are the high yielding currencies?

- Are interest rates expected to go up or drop?

This forms the basis of any further financial decisions, should more risks be taken? Or should more cash be held? Should loans be hedged, increased or decreased?

No. 3 Equities or Bonds

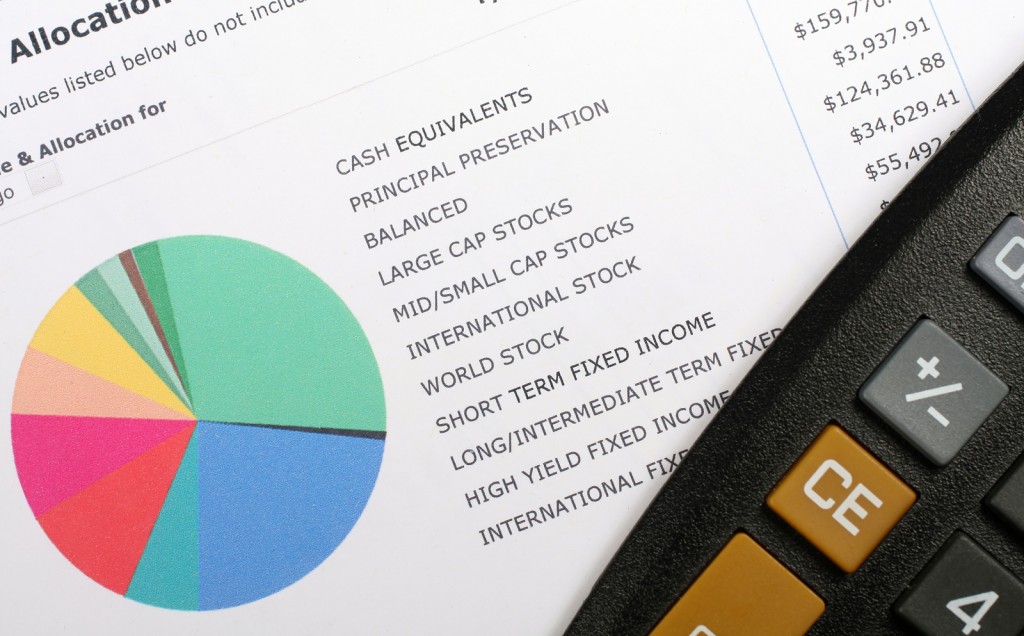

Inevitably, the seasoned advisor or investment specialist will quickly move onto the the 2 main asset classes: Is this the year for Equities or Bonds, both or none?

- Should more be allocated into bonds or equities?

- Or should more be held in cash?

- Should we wait?

List of Important Asset Classes

No. 4 Stocks, Securities, Unit Trust or Exchange Traded Funds

Unfortunately, getting into equities or bonds is the easier part. Which equity or bond to get into, is perhaps the toughest decision.

- Should you build the allocation by individual securities (stocks / bonds)?

- Should you use Unit Trust or Exchange Traded Funds?

No. 5 The Portfolio

If your client entrusts the portfolio decision-making to you, then you might be able to construct a proper portfolio. If your client cherry-pick the allocations, the portfolio might turn out to be a distorted one.

- How should the portfolio be constructed?

- Should all funds be allocated immediately?

Read More:

- What Investment Products Can You Place in Your Clients’s Portfolio?

- 8 Reasons Why Low-Risks Portfolios Do Not Work Effectively in Asia

- 8 Reasons Why You Can Construct a Portfolio Wrongly

- 10 Ways to Deal With a Portfolio Disaster

No. 6 Investment Management

Managing the portfolio is not going to be easy. The financial market is always moving. Currencies and interest rates are always fluctuating.

- How do you manage the risks during the year?

- What if there are more opportunities?

More:

- 7 Important Risks to Manage for Clients

- Do You Need to Assess the Risks of Financial Product Failures?

- Why Wealth Managers Struggle with Managing Investments?

No. 7 Cash & Cashflow

6 months of emergency funds? When was the last time your client used the excess cash?

- How much cash should your client hold?

- Should the cash be earmarked for investments?

- Is there any expected major incoming or outgoing cashflow?

No. 8 Loans

Loans are a great source of financing and cashflow for any clients, especially for real estate and investments.

- Is this a great time to take a loan or more loans?

- Would interest rates change affect current loan positions?

- Is there a more effective way to structure existing loans?

Read More:

- Different Types of Loans, Credit & Leverage Facilities

- 7 Ways Top Wealth Managers Create Value for Clients using Loans, Credit & Leverage

No. 9 Insurance / Endowment

Managing risks, low-risks, no-frills solutions. Insurance or endowment products are always a great discussion and addition to clients’ wealth plans.

No. 10 Wealth Structuring

For clients who are a little more affluent, high net-worth or ultra highnet-worth, wealth structuring is a big decision that sometimes may take many years to decide and setup.

- Is Wealth Structuring suitable for the client?

- How should the wealth be structured?

- Would there be material events that will cause client to change the structure?

These are 10 steps how you can start advising clients for the year.

Read More:

- 3 Secrets What Top Wealth Managers Do Everyday

- 8 Essential Skills to be a Top Wealth Manager

- 10 Questions Every Client Will Ask Every Year-End

- How Do You Conduct a Year-End Review for Your Clients?

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit