Samsung Heir Lee Jae-Yong Receives Parole, Samsung to Invest $205 Billion & Hire 40,000 in 3 Years

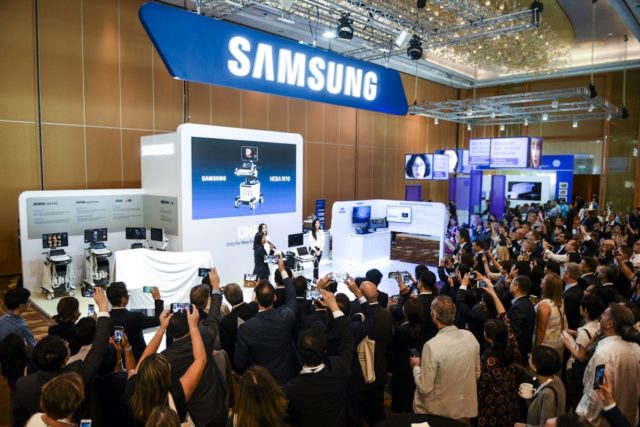

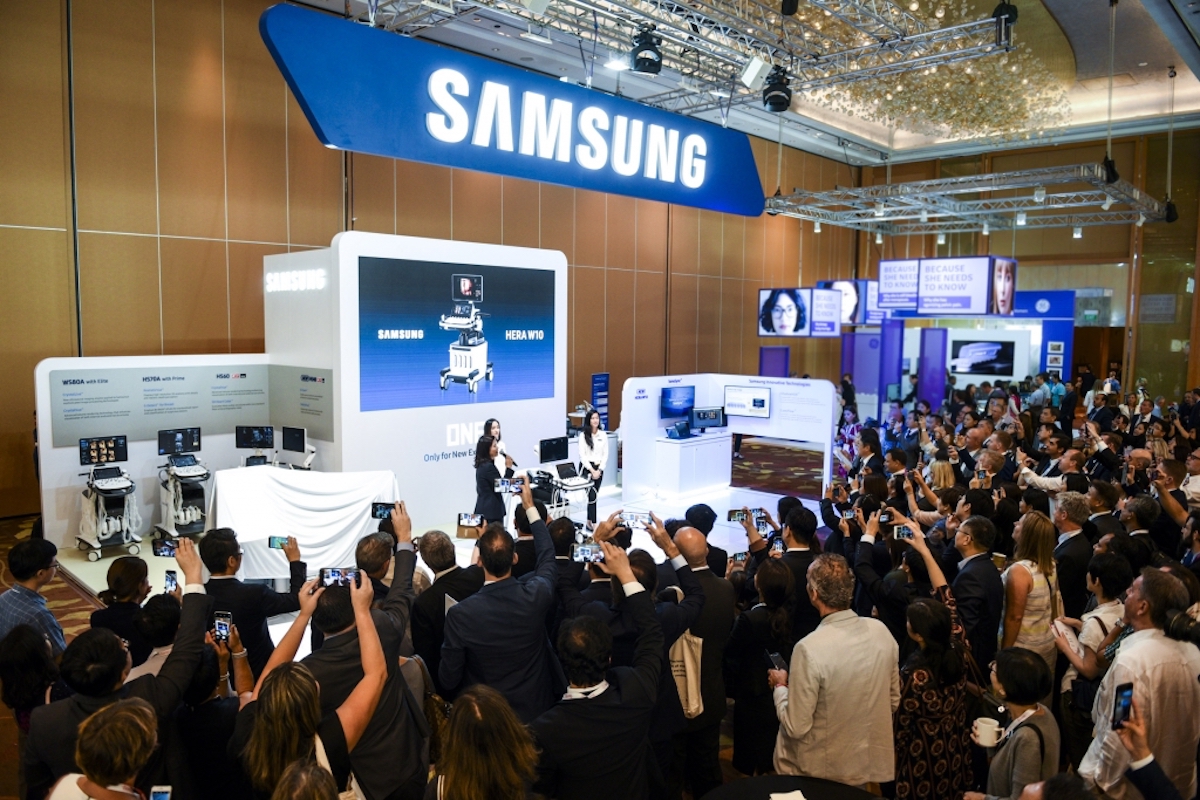

27th August 2021 | Hong Kong

Samsung Group heir Lee Jae-yong (Age 53), one of South Korea’s richest man with more than $11 billion fortune and who had just been released from jail on parole on the ground of national interest for semiconductors, has likely played a key role in Samsung Group announcement to invest $205 billion and make 40,000 new hires in 3 years. Samsung Electronics, Samsung Biologics and affiliates will invest $205 billion into technologies, semiconductors, robotics and other new programs to enable Samsung to be the market leader. Samsung Group is South Korea’s largest conglomerate with its yearly revenue at around 20% of South Korea’s GDP, and is the most recognised South Korea’s brand internationally and the world’s largest smartphone maker (Samsung Electronics).

“ Samsung Heir Lee Jae-Yong Receives Parole, Samsung to Invest $205 Billion & Hire 40,000 in 3 Years “

Samsung Group Heir Lee Jae-yong Released from Jail on Parole

The South Korean Justice Ministry had made the decision to release Samsung Group heir Lee Jae-yong on parole on the ground of national interest for semiconductors, vaccines after considering the effects of the pandemic on South Korea’s economy and global markets. His parole conditions include 5 years of business restriction and approval for overseas trip.

Samsung’s day-to-day operations is not affected by Lee Jae-yong absence, but need him to make major decisions on investments and M&A projects for Samsung. Lee Jae-yong is also under investigation for fraud and stock manipulation.

In August 2021, Samsung Group heir Lee Jae-yong (Age 53), one of South Korea’s richest man with more than $11 billion fortune, has been released from jail on parole, serving a fraction of his 2.5 years jail term for being convicted of bribery and embezzlement by a South Korean high court in January 2021. Lee Jae-yong was accused of paying $37 million to 2 non-profit foundations in exchange for political support to a Samsung merger that required support from South Korea’s government pension fund and for him to be the Head of Samsung. The case also involved South Korea’s former President Park Guen-hye, who is serving a 20 years jail term for bribery and corruption. (Parole ~ permission for a prisoner to be released before their period in prison is finished, with the agreement that they will behave well)

Samsung Heirs Lee Jae-Yong and Family to Pay $10.7 Billion in Inheritance Tax from $22 Billion Estate

Lee Jae-yong, the heir of Samsung Group is one of South Korea’s richest man with more than $11 billion fortune.

In April 2021, the heirs and family of Samsung including current Vice-Chairman of Samsung Electronics Lee Jae-Yong will have to pay inheritance tax of around $10.7 billion (12 trillion won), for inheriting around $22 billion estate from the late Samsung Chairman Lee Kun-Hee who died in October 2020.

The Lee family plans to pay the full amount of the inheritance tax over a period of 5 years, including reducing the inheritance tax through public donations of arts and medical funding. The $10.7 billion inheritance tax is likely to be paid from stock dividends and possibility of bank loans.

The estate’s collection of antiques and paintings will be donated to the National Museum of Korea and other cultural organisations. The collection includes national cultural assets and paintings by Korean painters such as Park Soo-keun and Lee Jung-seop and 23,000 art pieces including works by artists Marc Chagall, Pablo Picasso, Paul Gauguin, Claude Monet, Joan Miro and Salvador Dali.

For medical funding, the Lee family will donate around $900 million to fund infectious disease research and treatment for children with cancer and rare illnesses.

Samsung – Global Giant and South Korea Chaebol

The late Samsung Chairman Lee Kun-Hee had led Samsung in 1987, following the death of his father Lee Byung-chul, who founded Samsung. The late Samsung Chairman Lee Kun-Hee led Samsung through a massive transformation to become a global electronics giant. Today, Samsung is a global leader in technology, electronics and industry. In 2020, Samsung reported $212.4 billion in revenue and net income of $23.7 billion.

Samsung is also South Korea’s largest chaebol, a term used to describe South Korea’s large, family-run conglomerates that played an important role in the country’s economic development.

Related:

- Samsung Group Heir Lee Jae-yong Released from Jail on Parole, $11 Billion Personal Fortune

- Samsung Heirs Lee Jae-Yong and Family to Pay $10.7 Billion in Inheritance Tax from $22 Billion Estate

- Singapore: Need for Tax on Wealth, Inheritance, Estate & Property

- Singapore Central Bank MAS Reply on 15% Tax rate and Impact on Singapore as a Financial Centre

- OECD: 130 Countries Representing 90% of Global GDP Agree to 15% Corporate Tax Rate

- United States Billionaires Tax Leak, Top 25 Pays 3.4% in Tax Rate from $401 Billion Fortune

- G7 Nations Agree to Corporate Tax of at Least 15%, Hong Kong, Singapore & Switzerland Prepare for Change

- Hong Kong Private Equity Funds to Have 0% Tax for Carried Interest

- Former Prime Minister of Malaysia Najib Razak Faces Bankruptcy Notice for $408 Million in Unpaid Taxes

- HSBC UK Faces $1.61 billion Lawsuit for Tax-Efficient Disney Films Investments

- South Korean Billionaire & Chairman of Kakao Kim Beom-Su to Give More than Half His $10 Billion Fortune Away

- South Korea E-Commerce Giant Coupang IPO on NYSE, Rises 41% on Day 1

Exclusive

- KPMG Report & Global Family Business Tax Monitor 2020

- Interview with Sylvene Fong and Jackey Tse of KPMG China

- Interview with Shantini Ramachandra, Southeast Asia Tax Leader of Deloitte Private

- Interview with Dixon Wong, Head of Financial Services at InvestHK

- Interview with Richard Grasby, Founder of RDG Fiduciary

- Interview with Cem A. Azak, Executive Chairman of Crossinvest

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit