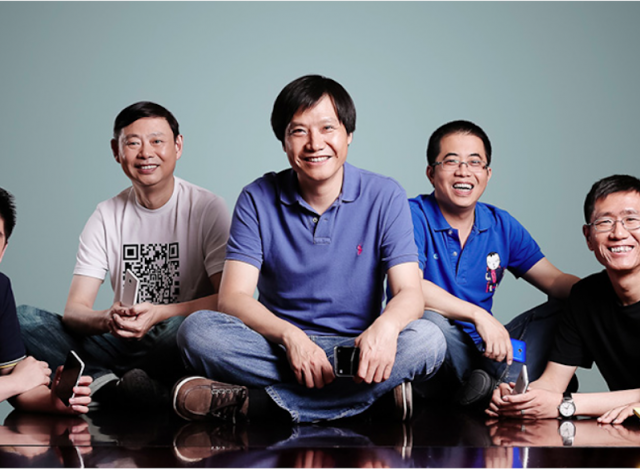

Xiaomi Founder & Billionaire Lei Jun Donates $2.2 Billion of Shares to Charity

22nd July 2021 | Hong Kong

Xiaomi founder & billionaire Lei Jun has donated $2.2 billion of Xiaomi shares to 2 charitable foundations co-founded by him (HKEX filing 16/7/21), with his shareholding at 10.6% after the share transfer. Lei Jun is one of China’s richest man and the founder of the 2nd largest smartphone maker in the world, with a net worth of more than $22 billion. The largest smartphone maker in the world is Samsung, followed by Xiaomi and Apple.

“ Xiaomi Founder & Billionaire Lei Jun Donates $2.2 Billion of Shares to Charity “

Xiaomi Founder & Billionaire Lei Jun, Philanthropist

Lei Jun’s $2.2 billion donation, joins the growing list of billionaires in giving their money away.

In March 2021, now South Korean richest billionaire and Chairman of South Korean internet and technology giant Kakao Kim Beom-Su and his wife (Miseon Hyeong) signed The Giving Pledge to donate more than half of their $10 billion assets to society. In the same month, South Korean billionaire Kim Bong-Jin and his wife Bomi Sul also signed The Giving Pledge. Kim Bong-jin is the founder & CEO of Woowa Brothers, which started the largest food delivery app (Baedal Minjok) in South Korea.

- South Korean Billionaire & Chairman of Kakao Kim Beom-Su to Give More than Half His $10 Billion Fortune Away

- Billionaire Warren Buffett Resigns from Bill and Melinda Gates Foundation, $49 Billion Endowment

- Billionaires Bill Gates & Melinda Divorce, $150 Billion Assets

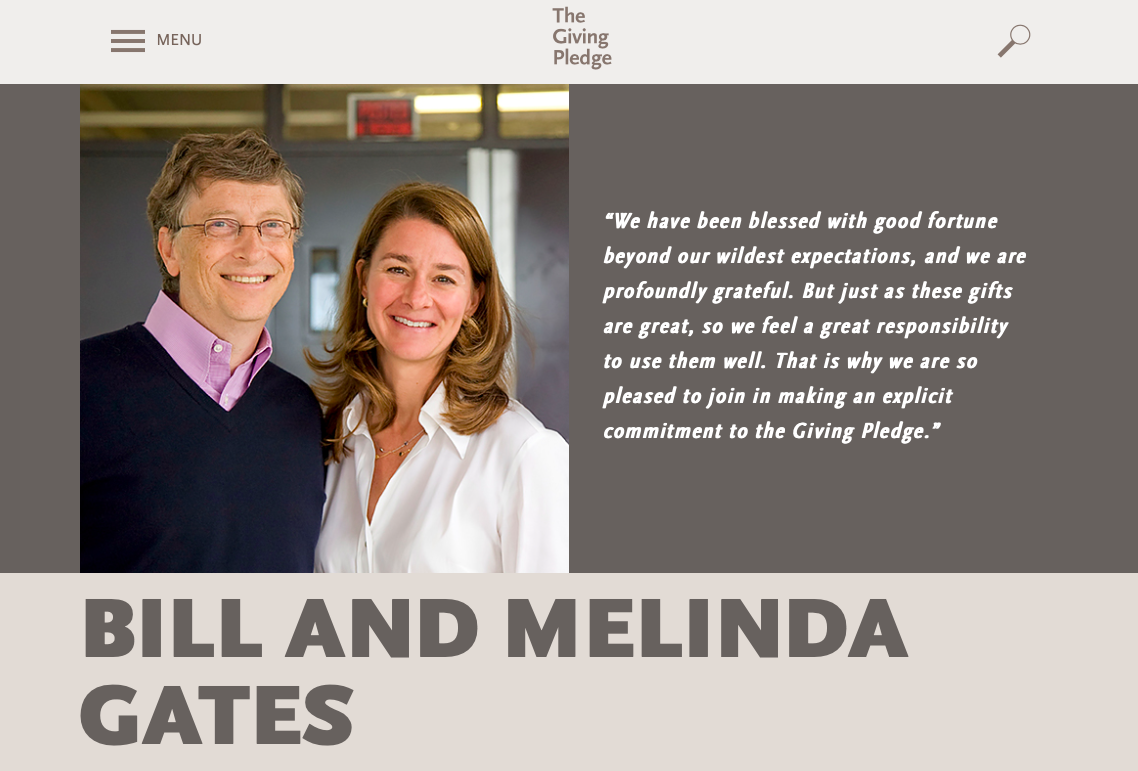

The Giving Pledge – For Billionaires

The Giving Pledge is a global philanthropic movement launched in 2010 by Microsoft chairman Bill Gates and his wife Melinda Gates along with Berkshire Hathaway chairman Warren Buffett with a total of 40 billionaires. The Giving Pledge is a moral commitment by the world’s wealthiest to give the majority of their wealth to charitable causes.

Currently, there are 220 pledgers from 25 countries.

Notable names are:

- Facebook founder Mark Zuckerberg and Priscilla Chan ($103 billion)

- Tesla founder Elon Musk ($162 billion)

- Oracle founder Larry Ellison ($90 billon)

- Virgin Group founder Richard Branson and Joan Branson. ($5 billion)

- Linkedin founder Reid Hoffman and Michelle Yee ($2 billion)

- David Rockefeller, deceased 2017 (3.8 billion)

Notable names from finance are:

- Bridgewater Associates founder Ray Dalio & Barbara Dalio ($20 billion)

- Blackstone founder Stephen Schwarzman ($23 billion)

- Carlyle Group founder David Rubeinstein ($4 billion)

- Bloomberg founder Michael Bloomberg ($59 billion)

- Icahn Enterprises founder Carl Icahn ($15 billion)

- Tudor Investment founder Paul Tudor Jones and Sonia ($7 billion)

(est. current networth)

Signers of the Giving Pledge

Signers of the Giving Pledge commit to give the majority of their wealth to philanthropy, either during their lifetimes or in their wills.

To Join the Giving Pledge

To join the Giving Pledge, billionaires will need to have at least $1 billion in personal net worth and and are ready to make a public pledge to donate the majority of their personal wealth to philanthropy. Visit: The Giving Pledge

Billionaires:

- UK Largest Divorce Payout from Russian Billionaire Farkhad Akhmedov, Settles at $186 Million from Original $620 Million

- British Fintech Wise IPO Creates 2 New Billionaires with $3.55 Billion

- China Premium Tea Nayuki IPO in Hong Kong, Creates 2 New Billionaires with $1.1 Billion Each

- Didi Global IPO Creates 2 New Self-Made Billionaires, Founder Will Cheng Wei with $4.4 Billion

- Billionaire Warren Buffett Resigns from Bill and Melinda Gates Foundation, $49 Billion Endowment

- United States Billionaires Tax Leak, Top 25 Pays 3.4% in Tax Rate from $401 Billion Fortune

- Didi Chuxing IPO Creates 2 New Self-Made Billionaires, Founder Will Cheng Wei with $7 Billion

- Billionaires Bill Gates & Melinda Divorce, $150 Billion Assets

- Billionaire James Dyson Switches Residency Back to UK from Singapore

- South Korean Billionaire & Chairman of Kakao Kim Beom-Su to Give More than Half His $10 Billion Fortune Away

- Billionaire & Google co-Founder Sergey Brin Setup Family Office in Singapore

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- June 2024 - Hong Kong

- June 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Investment Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit